Introduction to Binance

Binance has emerged as one of the leading cryptocurrency exchanges since its inception in 2017. With its user-friendly interface and extensive range of cryptocurrencies, it has attracted millions of users globally. Whether you are a novice or an experienced trader, understanding how to maximize your trading potential on Binance can lead to substantial financial gains. In this article, we will delve into various strategies, tips, and personal insights to elevate your trading experience and make the most out of Binance.

Understanding the Basics of Crypto Trading

Before diving deep into trading strategies, it's crucial to grasp the basics of crypto trading. At its core, trading involves buying and selling assets to generate profits. In the crypto world, this means exchanging one cryptocurrency for another or for fiat currency. Binance facilitates this through a variety of trading pairs.

One important aspect to consider is market volatility. Cryptocurrencies are known for their price fluctuations, which can present both opportunities and risks. For instance, Bitcoin might spike in value one day and plummet the next. Understanding the dynamics of these fluctuations is essential for successful trading.

Exploring Binance Features

Binance offers a plethora of features that cater to both beginner and advanced traders. The platform provides a secure wallet, charting tools, various order types, and even a futures market. For a new trader, starting with basic features like spot trading can be beneficial. Once comfortable, you can then explore advanced functionalities, such as margin trading and futures.

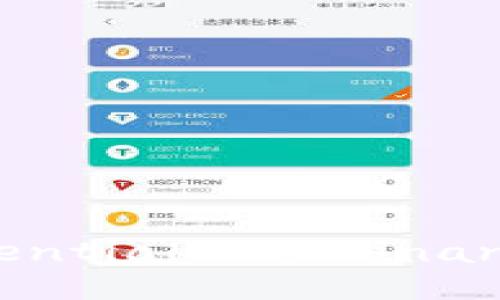

One particularly appealing feature of Binance is the array of cryptocurrencies available for trading. The platform supports over 500 coins, giving traders the flexibility to explore less popular assets that might be undervalued. This diversity enables traders to diversify their portfolios, which can mitigate risks.

Developing a Trading Strategy

A well-defined trading strategy is critical for success on Binance. Here are some popular strategies to consider:

- Day Trading: This involves making multiple trades in a single day based on short-term price movements. It requires a good understanding of market trends and technical analysis.

- HODLing: This long-term investment strategy involves buying cryptocurrencies and holding them for an extended period, irrespective of price volatility. This strategy assumes that the value of cryptocurrencies will increase over time.

- Scalping: This is a short-term strategy where traders make small profits from tiny price changes. Scalping can be labor-intensive but can yield substantial returns.

- Trend Following: Following market trends and making trades that align with them is another effective strategy. This requires keeping up with news and market analysis.

Personally, I find that a mix of day trading and HODLing works best for my style. Day trading allows for quick profits while HODLing provides a safety net for long-term growth.

Risk Management and Emotional Discipline

In trading, risk management is as crucial as developing strategies. Cryptocurrencies can be highly unpredictable, and without proper risk management, you could face significant losses. Consider setting stop-loss orders to limit your losses. This means determining a price level at which you will exit a position, which helps in minimizing potential losses.

Moreover, emotional discipline cannot be overstated. Trading based on emotions rather than logic can lead to impulsive decisions. For instance, during a market surge, investors may feel tempted to buy into overpriced assets, only to watch their investments plummet. Keeping emotions at bay is vital; sticking to your trading plan should be the priority.

Continuous Learning and Adaptation

The crypto market is constantly evolving. New technologies, regulations, and market sentiments can dramatically influence trading strategies. Therefore, continuous learning is imperative. Following reputable sources, joining online trading communities, and attending webinars can provide valuable insights. Additionally, experimenting with demo accounts can help you practice and refine your strategies without risking real money.

In my experience, staying updated on market trends and technological advancements has often led me to undervalued cryptocurrencies, yielding significant returns. For instance, following a new blockchain technology closely enabled me to invest early in a rising token, which paid off handsomely.

Leveraging Binance's Community and Resources

One often overlooked aspect of Binance is its vibrant community and educational resources. The Binance Academy, for instance, covers a wide range of topics, from beginner tips to advanced trading strategies. Engaging with community forums can provide real-world experiences and insights from fellow traders.

Another resource is Binance's regular webinars and community programs that offer guidance and tips from experts. Participating in these can enhance your understanding of market dynamics and trading tactics.

Conclusion: Your Path to Successful Trading on Binance

Trading on Binance presents immense opportunities; however, it also comes with risks. By developing a solid trading strategy, implementing robust risk management practices, and continuously educating yourself, you will be well-positioned to maximize your trading potential. Always remember that the world of cryptocurrency is fast-paced and requires adaptability. Don't hesitate to refine your strategies and learn from both successes and failures.

In the end, patience and consistency are key. Over time, with dedication and diligence, you can transform your trading experience into a fruitful endeavor. Happy trading!